How to Log In for the Discover Credit Card

Discover Bank – An Introduction

Discover Bank is owned and operated by Discover Financial Services which is an American financial service providing company. Previously the bank was named the Greenwood Trust Company. Discover is an American monetary organization, which was established early in 1985 by the Sears group. The administrative head office of the organization is situated in River woods, Illinois, USA. It offers checking and savings accounts, personal loans, home equity loans, student loans, and credit cards. Discover and Pulse Networks and Diners Club International are also operated and owned by Discover Financial Services.

The organization primarily has given its service in the United States and it is one of the top brand Credit Cards to its highlights and market fascination. Inside the United States, Discover Card is ranked as the third-largest credit card brand in the United States, when measured by cards in force, within the Credit card industry, behind Visa, MasterCard, and American Express. As its market is continuously growing, it serves more than 50 million cardholders in the United States.

The organization is currently providing credit products and financial banking services that help people to achieve their goals from establishing good credit, to paying for a college education to consolidating debt. With innovative commerce solutions in terms of payments, the bank has served their networks connected banks, card members, and merchants around the world. Discover Bank, always kept its focus to be the leading digital bank and payments partner in the market. Their primary mission is to help out people to spend in a smarter way, manage their debts better, and to save more money so they achieve a better and brighter financial future.

Discover has always provided 100% U.S.-based Customer Care Services. The organization is providing competitive paying jobs to customer service representatives who have a stake in the success of their business and have cared for the customers. They are always committed to serve their customers with quick, simple, easy-to-understand information and tools to help make more informed financial decisions.

Presently, the majority of the cards in the Discover Brand are distributed by the Discover Bank. The company transactions are handled by the Discover Network Payment. The organization always believed in being a good corporate citizen, particularly in communities where their employees live and work. They treat their customers like neighbors. Always being there to serve the customers has makes a difference for them as a trusted organization in the market.

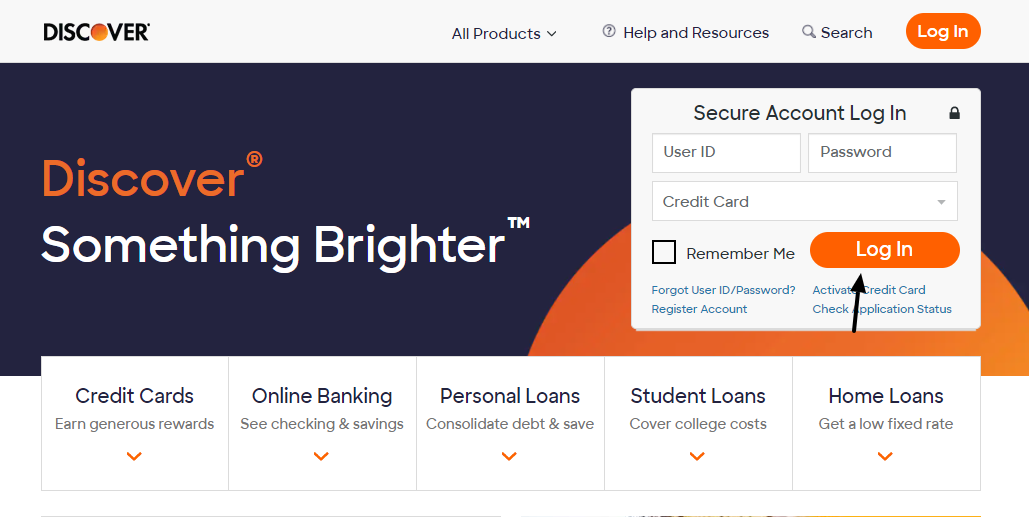

How to Log In for the Discover Credit Card

To get Log In to the account, you have to previously get Registered with the Discover Credit Card account, after that point you can without much hassle can LOG IN to your record, utilizing User ID and Password. Now to Log In adhere to the step by step guidelines underneath:

- Go to the main official website of Discover.

- You can also tap this connection at www.discover.com

- Then, on the landing page enter your “User ID” and “Password” in the given spaces.

- You can also check the box, “Remember Me”, to Remember your User Identification (ID).

- Now, by tapping on the “Log In” bar button, you can proceed.

Discover Credit Card – How to Register

You need to first get registered, to access your Credit Card information. To get Registered for the Discover Credit Card account, you need to follow these directions below:

- Tapping on this connection www.discover.com go to the main website.

- Search and tap on the “Register Account” tab on the landing page.

- Under the Credit Cards heading, click on the “Register Now” link tab.

- Here on the “REGISTER YOUR ACCOUNT” page, enter your 16-digit Credit Card number, Credit Card Expiry Date (MM /YY), Date of Birth (DOB), and Last 4 digits of the Social Security Number (SSN), etc.

- Then, click on the “CONTINUE”

- After that, follow the further on-screen directions to finish the Registration process.

Step by Step instructions to Apply for the Discover Credit Card :

It is quite simple to APPLY for the Discover Credit Cards. You simply need to follow some exceptionally basic guidelines to Apply for the Discover Credit Cards. In the beginning, you may confront a couple of issues. In that situation, just follow the simple steps to complete the application:

- Visit the authoritative site of Discover or click on www.discover.com

- Go to the Credit Cards option, on the landing page and snap on “All Credit Cards”.

- You can find here, different types of Credit Cards offered by Discover are accessible.

- Then, tap on the “Apply Now” tab of your choice to apply for any card.

- Put down your ZIP Code, the Last 4 digits of the Social Security Number (SSN), Date of Birth (DOB in MM /DD /YYYY), etc then press the “Continue”

- Here on another page, you need to pick up a DESIGN for your Credit Card.

- Then, enter your data, Your Name, Home Address, Date of Birth (DOB in MM/ DD/ YYYY), Employment Status, Monthly Housing / Rent Payment, Total Gross Income, Email Address, etc.

- Select the “Agree to Terms and Conditions”

- Then, tap on the “SUBMIT”

Discover Credit Card – How to Reset or Forgot User ID or Password:

Regardless, if you failed to remember your User ID or Password, at that point you can adhere to these guidelines beneath:

- Go to the landing page of Discover.

- Under the Log In tab, click on the “Forgot User ID or Password”

- On the next page under CREDIT CARDS head, choose “Forgot User ID” or “Forgot Password” or “Forgot Both”, as per your requirement.

- Then, on another webpage enter your 16- Digit Card Number, Card Expiration Date, Primary Card Member’s Date of Birth (DOB), Primary Card Member’s Last 4 Digits of the Social Security Number (SSN), etc.

- Lastly, click on the “Continue” button and follow the on-screen instructions.

Various Credit Cards offered by Discover

The Discover Bank offers various types of Credit Cards for its prestigious customers. Some of them are briefly discussed below.

Discover It Cash Back Credit Card and NHL Discover It Credit Card

Advantages:

- You can earn 5% money back at various market places each quarter on your regular purchases.

- Get 1% limitless Cash Back on all other purchases.

- Avail 2X limitless dollar-for-dollar match of all the money back at the end of your first year automatically.

Discover It Gas and Restaurants Credit Cards:

Advantages:

- Acquire up to 2% money back every quarter for spending up to $1,000 in combined transactions at the eateries, and gas stations.

- On other various buys, get limitless 1% money back automatically.

- Get 2X limitless rewards at the end of your first year automatically, here $75 becomes $150, and $100 becomes $200 automatically.

Rates and Interests:

- Annual Fee – $0 (No Fee).

- Balance Transfer – Introductory Fee is 3%, afterward 5% will be charged.

- Cash Advance – Fees are 5% or $10 whichever is greater.

- Late Payment – No Fee is charged for the first time, afterward up to $40.

- Returned Payment – Up to $40 is charged.

- APR for Purchase and Balance Transfer – Introductory fees are 0% for the initial 14 months. After that period variable Annual Percentage Rate (APR) is 11.99% to 22.99% based on your creditworthiness.

- APR for Cash Advances – The charges are 24.99% variable based on market Prime Rate.

- Minimum Interest Charge – The charges is not less than $0.50.

- Penalty APR and When It Applies – None.

Also Read : How to Activate the Chase Credit Card

All About – Student Cash Back and Student Chrome by Discover :

Advantages:

- Discover Student Cash Back – Students can earn a 5% Money-Back on their regular purchases during the school year at different places like restaurants, Gas Stations, Grocery Stores, and Amazon.com, etc.

- Discover It Student Chrome – You can get more than 2% Money-Back at Gas Stations and Restaurants on spending $1,000 each quarter in combined purchases.

- You can get 2X limitless rewards at the end of your first year automatically, here $50 becomes $100, and $100 becomes $200 automatically, applicable for both the cards.

- Students can build their credit history, utilizing both cards.

Rates and Interests:

- Annual Fee – $0 (No Fee).

- Balance Transfer – Welcome Fee is 3%, afterward 5% will be charged.

- Cash Advance – Fees are 5% or $10 whichever is greater.

- Late Payment – No Fee is charged for the first time, afterward up to $40.

- Returned Payment – Up to $40 is charged.

- APR for Purchase – Introductory fees are 0% for the initial 6 (six) months. After that period variable Annual Percentage Rate (APR) is 12.99% to 21.99% based on your creditworthiness.

- Balance Transfer – Welcome fees are 10.99% for the initial 6 (six) months. After that period variable Annual Percentage Rate (APR) is 12.99% to 21.99% based on your creditworthiness.

- APR for Cash Advances – The charges are 24.99% variable based on market Prime Rate.

- Minimum Interest Charge – The charges is not less than $0.50.

- APR Penalty and When It Applies – None.

Discover Travel Credit Card:

Advantages:

- You can gather 1.5X Miles limitless reward points. Redeem your Miles points for Money Back or as a statement credit against a travel transaction.

- Unlimited Miles points can be earned, and points are matched automatically at the end of the first year like 35,000 Miles Points become 70,000 Miles, which is equivalent to $700 for you.

- There is no minimum spending is required, utilizing this Travel Credit Card.

- You can also get Cash for the things as per your requirement, using this card.

- This Miles Travel Card can help you with the cost of traveling to remote locations or local road travels, all without any blackout dates. You can also redeem Miles Points as a statement credit for your tour and travel purchases like hotels, restaurants, airfare and gas stations, etc.

- Using your PayPal account, you can use your gathered Miles Points at Amazon.com buys.

- Discover Credit Cards are accepted by 99% of the locations all across the country, wherever credit cards are accepted.

Rates and Interests:

- Annual Fee – $0 (No Fee).

- Balance Transfer – Welcome Fee is 3%, afterward 5% will be charged.

- Cash Advance – Fees are 5% or $10 whichever is greater.

- APR for Purchase – Introductory fees are 0% for the initial 14 (fourteen) months. After that period variable Annual Percentage Rate (APR) is 11.99% to 22.99% based on your creditworthiness.

- Balance Transfer – Welcome fees are 10.99% for the initial 14 (fourteen) months. After that period variable Annual Percentage Rate (APR) is 12.99% to 21.99% based on your creditworthiness.

- APR for Cash Advances – The charges are 24.99% variable based on market Prime Rate.

Discover It Secured Credit Card

Advantages:

- Accumulate your 2% Money-Back on purchases up to $1,000 at Restaurants and Gas Stations.

- Earn limitless 1% on all other transactions.

- Build a better credit history using your Discover Secured Credit Card.

- Your Secured Credit Card needs a Refundable Security Deposit, the amount you choose to deposit will be your credit line approved limit, like a $100 deposit for a $100 credit Line or a $400 deposit for a $400 credit line approved.

- Paying late will not raise your Annual Percentage Rate (APR) and there is no Late Fee on your first late payment.

Rates and Interests:

Please Note: Same as Discover Student Cash Back and Discover It Student Chrome’s charges.

Discover It Business Credit Cards:

Advantages:

- You can avail of 1.5% unlimited automatic money back on each dollar you spend on all transactions.

- Add on all your employee’s credit cards and earn rewards based on all of their purchases.

- Get the advantage of paying No Annual Fees.

- Your earned Reward Points never expire as long as your account is in active mode. Redeem your points any time anywhere. You can also apply for your earned Reward Points as cash and towards your online purchases at Amazon.com.

- Avail your 2X limitless dollar-for-dollar match of all the money back at the end of your first year automatically, like $350 money-back becomes $700.

- All benefits with No Minimum purchase limit and no limit for how much Discover will match.

- Discover Credit Cards are accepted by 99% of the locations all across the country, wherever credit cards are accepted.

Rates and Interests:

- Annual Fee – $0 (No Fee).

- Balance Transfer – A total of 5% will be charged on the amount of each transfer.

- Cash Advance – Fees are 5% or $10 whichever is greater.

- APR for Purchase – Welcome fees is 0% for the initial 12 (twelve) months. After that period variable Annual Percentage Rate (APR) is 12.99% to 20.99% based on your creditworthiness.

- APR for Cash Advances – The charges are 24.99% variable based on market Prime Rate.

- Minimum Interest Charge – The charges is not less than $0.50.

Contact No:

Customer Service:

Discover Financial Services

P.O. Box 30943

Salt Lake City, UT 84130-0943

Credit Card Payment Address:

Discover Financial Services

P.O. Box – 6103 Carol Stream,

IL 60197 -6103

Phone Numbers:

Customer Care Service (Call): 1-800-DISCOVER (1-800-347-2683) (For U.S.)

Customer Care Service (Call): 1-801-902-3100 (For Outside the U.S.)

Customer Care Service (Call): 1-800-347-7449 (For Telecommunications Device for the Deaf – TDD)

Reference Link :